I had decided it was time to make a change in my life—something that would not only secure my future but also bring a fresh sense of purpose to my everyday routine. When I first started buying property in Turkey, I was introduced to an entirely new world. From images of modern developments in Istanbul to promises of citizenship, everything looked incredibly tempting. But to be honest, I was also overwhelmed. How could I be sure I was making the right decision?

Was my investment really going to the right place?

That’s when I realized the importance of having a reliable real estate consultant in Istanbul—someone who could guide me through the entire process and make everything clear. What follows is the story of my experience buying property in Turkey—from the very first steps to the moment I held the keys to my new home.

My Experience of Buying Property in Turkey

After making the initial decision, the first question that occupied my mind was: how could I choose the best option among so many different projects in Istanbul? Especially when I had heard that buying property in Turkey directly from the developer could offer significant advantages. That’s why I began researching and consulting with trusted real estate advisors in Istanbul. These consultants not only helped me get familiar with the various projects in the city, but also eased my concerns by providing detailed information about prices, amenities, and legal procedures.

At first, I was a bit confused. There were so many different types of properties—ranging from luxury apartments with sea views to villas in quieter neighborhoods. But with the help of a consultant from Aloproperty, I quickly realized that buying property in Turkey required careful consideration. My consultant explained that I needed to pay attention to factors like location, project facilities, and the long-term outlook of the real estate market.

However, I also had a bitter experience that I’ll never forget. I didn’t know that before signing a contract, I should thoroughly investigate the legal status of the property. I had chosen a project I really liked, but later discovered that it still had some unresolved legal issues. As a result, the buying process was delayed for several months, costing me a lot of time and energy. Fortunately, after that mistake, the consultants at Aloproperty taught me to review such matters beforehand to avoid any future problems when buying property in Turkey.

I remember visiting the first project I had considered—it felt like everything was falling into place. The project had full amenities, from a swimming pool and gym to spacious green areas and proximity to shopping centers. That’s when I realized how valuable it is to have a trustworthy real estate consultant in Istanbul who can help guide you to the right choices when buying property in Turkey. For me, it wasn’t just about finding something cheap. I wanted to make sure my purchase would also be a profitable investment for the future.

Over time, the path became much clearer to me. The legal process of buying property in Turkey can be quite complex, and without the support of the Aloproperty consultants, I might have faced serious challenges. But with their help, everything went more smoothly and transparently, and I was able to make my final decision with full confidence. In the end, when I finally held the keys to my new home, it felt amazing—not only had I found a new place to live, but I had also made a valuable investment for my future.

Advantages of Buying an Apartment in Turkey

Buying property in Turkey has become one of the most popular options for both investment and immigration—and for good reason. One of the greatest advantages is the opportunity to obtain Turkish citizenship by investing at least $400,000 in real estate, which covers the investor and their family. Turkey’s real estate market has shown steady growth in recent years and offers high returns, especially in vibrant cities like Istanbul and Antalya. The wide variety of residential and commercial projects—from modern downtown apartments to luxurious beachfront villas—allows buyers to find options that match their tastes and budgets.

In addition, the cost of living in Turkey is significantly lower than in many European countries, which makes it an attractive destination for permanent living or vacations. Combined with its unique geographical location as a bridge between Asia and Europe, Turkey’s appeal as a place to live and invest is stronger than ever.

Furthermore, based on official data from TÜİK (Turkish Statistical Institute), the number of residential property sales from January to November increased by 16.4% compared to the same period the previous year, reaching 1,265,388 units. This growth reflects the stability and high demand in Turkey’s housing market, offering secure and profitable investment opportunities for buyers interested in buying property in Turkey.

Property Prices in Different Cities of Turkey

In recent years, the real estate market in Turkey has seen significant changes in property prices, reflecting both local demand and economic growth. When considering buying property in Turkey, it is important to understand that prices vary greatly depending on the city and its geographical location. Factors such as infrastructure development, tourism, and investment potential contribute to these differences.

The table below illustrates the average price per square meter of property in several major Turkish cities, along with the annual price increase over the past year. This data can help prospective buyers make informed decisions when buying property in Turkey, whether for investment or residence. (1 Dollar ≈ 38 Turkish Lira )

Best Cities to Buy an Apartment in Turkey

Istanbul is undoubtedly the top destination for buying property in Turkey. With its strategic location and status as the country’s economic and cultural hub, Istanbul consistently ranks at the top for real estate investment. However, other cities such as Izmir—with its beautiful coastline, Antalya—with its excellent climate, and Bursa—with its affordable prices—also offer excellent opportunities for buying property in Turkey. Each city has unique characteristics, making them attractive options for different types of buyers.

Real Estate Sales Statistics in Turkey (Updated to April 2025)

Understanding real estate sales statistics in Turkey is essential for investors and buyers interested in buying property in Turkey. These insights help identify market trends and forecast future developments in the housing sector. Thanks to Turkey’s steady economic growth and increasing housing demand—especially in major cities like Istanbul, Ankara, and Izmir—careful monitoring of these statistics reveals promising investment opportunities. Government policies and demographic changes also significantly influence the market. Being aware of these factors allows smarter decisions when buying property in Turkey.

According to official data from the Turkish Statistical Institute, a total of 130,025 properties were sold in May 2025. This represents a significant increase compared to May 2024, with a growth rate of 17.8%. The chart below shows the monthly property sales figures from 2023 to 2025.

Foreign Property Sales in Turkey

Now let’s examine the number of property sales in Turkey to foreign nationals. According to statistics published by the Turkish Statistical Institute, 1,771 properties were sold in May 2025. Compared to the same month in the previous year, there has been a decline, with property sales to foreigners decreasing by 16.55% compared to May 2024. The chart below shows the number of property sales to foreigners for each month from 2023 to 2025.

The cities leading in foreign property purchases in May 2025 were:

Istanbul with 648 units,

Antalya with 594 units,

and Mersin with 145 units.

These figures highlight key hotspots for foreigners buying property in Turkey, reflecting their growing interest in the country’s real estate market.

Out of the total number of property sales to foreigners in May 2025, Iranian buyers purchased 133 units, ranking second among all foreign nationalities buying property in Turkey. Russian buyers took the top spot, with 274 units purchased during the same month.

The chart below shows the property purchases by foreign nationals in detail, highlighting the diverse interest in buying property in Turkey from different countries.

Apartment Prices in Istanbul – 2025

Istanbul offers a wide variety of property types and pricing options, making it a prime choice for those buying property in Turkey. On the Asian side of the city, neighborhoods such as Kadıköy, Üsküdar, and Beykoz are considered upper-mid-range areas. In Kadıköy and Üsküdar, prices for standard apartments start from around $250,000, while apartments in residential complexes (residences) begin at approximately $350,000. Beykoz is famous for its villa-style housing, with villa prices starting from $1.5 million.

In the mid-range Asian districts like Ataşehir, Maltepe, Ümraniye, and Kartal, standard apartments typically start from around $150,000, and residence apartments from approximately $250,000. Pendik, which is farther from the city center, offers more affordable options, with standard apartments starting at $120,000 and residences from $200,000.

On the European side of Istanbul, districts such as Beşiktaş, Şişli, and Sarıyer are among the upper-mid-range neighborhoods popular for buying property in Turkey. Here, standard apartments start at around $350,000, with residence apartments priced from $500,000. Sarıyer is also well-known as one of Istanbul’s premier villa zones, where villa prices start at about $1 million. This area is home to some of the city’s most luxurious and expensive villas, attracting high-end buyers interested in buying property in Turkey.

Districts such as Kağıthane, Bakırköy, and Beyoğlu, which fall into the mid-range category on the European side of Istanbul, offer standard apartments starting from around $200,000, while residence-style apartments begin at approximately $350,000. In the western parts of Istanbul, there are more affordable neighborhoods where property prices can start as low as $100,000. These areas provide attractive options for those interested in buying property in Turkey on a budget.

However, it is important to pay close attention to neighborhoods where residence permits are restricted for foreigners. Additionally, even within the same district, some neighborhoods may have lower levels of safety or social standards. If you come across unusually low property prices, there is a high chance the property may be located in such restricted or less desirable areas. Therefore, careful research and guidance from a knowledgeable advisor are essential when buying property in Turkey.

The table below shows the price per square meter for apartments across different districts of Istanbul. It also includes the annual change in apartment prices, and in the final column, a forecast of expected price trends over the next six months—valuable data for anyone buying property in Turkey and seeking to make an informed investment.

Rules for Buying Apartments in Turkey for Foreign Nationals

Buying property in Turkey has become an attractive and popular choice worldwide. For those looking to invest or find a second home in this beautiful country, being aware of the property purchase laws in Turkey is very important. Fortunately, the Turkish government has created favorable conditions for foreigners to buy property. However, there are some key points and restrictions to keep in mind.

The first question many foreign buyers ask when buying property in Turkey is whether the conditions are the same as for Turkish citizens. In fact, many foreigners can easily purchase property in Turkey, but certain limitations apply. Generally, foreigners can buy up to 30 hectares of land or property in Turkey. Additionally, in each province, the total amount of property sold to foreigners must not exceed 10% of the total land area of that province.

Buying Property in Turkey and Obtaining Turkish Citizenship – Updated Laws for 2025

In recent years, the Turkish government has introduced new and important laws to better manage the real estate market and facilitate the property purchase process for foreign nationals. Being informed about these laws can make the process of buying property in Turkey and obtaining Turkish citizenship or residency much clearer and easier.

Minimum Investment Amount for Citizenship: $400,000

According to the latest law passed on April 13, 2022, Turkish citizenship through property purchase is only possible by buying real estate worth at least $400,000 USD. This regulation came into effect on June 13, 2022. Furthermore, starting from March 1, 2023, it was stipulated that citizenship can be granted for only one family (consisting of the couple and their children under 18) per property deed valued over $400,000.

Three-Year Non-Sale Period for Citizenship Properties

After purchasing the property, an official annotation is added to the title deed, stating that the property must remain in the buyer’s ownership for at least three years. If the property is sold before this period ends, the granted citizenship will be revoked.

These important rules ensure that foreign buyers engaging in buying property in Turkey for citizenship purposes fully comply with legal requirements and maintain long-term investment commitments.

Foreign Currency Transfer and Döviz Alım Belgesi (Foreign Exchange Purchase Certificate):

Since January 1, 2022, foreign buyers engaging in buying property in Turkey must transfer the purchase amount in foreign currency (such as USD or other accepted currencies) into their own Turkish bank account and then transfer it to the seller through the Central Bank of Turkey. For this transaction, the Central Bank issues a document called the Döviz Alım Belgesi (Foreign Exchange Purchase Certificate), which is mandatory to present during the property transfer process.

Exemption from Expert Appraisal Report (Ekspertiz):

According to a new government directive dated June 13, 2024, buyers purchasing properties from companies licensed as REITs (Real Estate Investment Trusts – GYO) are exempt from providing an expert appraisal report. However, when buying property in Turkey from projects without this license or purchasing second-hand properties, submitting an expert appraisal report remains mandatory.

Buying Apartments in Turkey and Obtaining Residency

For those seeking residency through apartment purchase, if the property price exceeds $200,000 USD, providing an expert appraisal report is not required. It is sufficient that the actual purchase price is accurately stated on the title deed (Tapu).

Please note that purchasing commercial or office properties does not qualify for Turkish residency. Additionally, buying two separate apartments totaling $200,000 does not qualify; at least one of the purchased units must individually be valued over $200,000 USD to be eligible for residency.

These regulations demonstrate the Turkish government’s efforts to better regulate the real estate market and prevent misuse and tax evasion. Being fully aware of and complying with these rules is essential for a successful and secure process when buying property in Turkey.

Important Points to Consider When Buying an Apartment in Turkey

When buying property in Turkey, one crucial step is obtaining a tax identification number (vergi numarası). This number is mandatory for all individuals and legal entities involved in financial or legal transactions in Turkey, including property purchases. Without a tax number, foreign buyers cannot proceed with the transaction.

After acquiring the tax number, opening a Turkish bank account is essential. This account facilitates payments related to the property purchase, fund transfers, and tax obligations during the buying property in Turkey process.

Although the property purchase procedure in Turkey is relatively transparent compared to many countries, careful attention and consultation with reputable real estate consultants are vital. Engaging a professional advisor ensures a smooth and secure experience while buying property in Turkey, helping avoid common pitfalls.

Required Documents for Property Purchase and Sale in Turkey

Gathering all necessary documents beforehand is a critical part of buying property in Turkey. Both the buyer and seller must prepare these documents before signing contracts to prevent delays and legal complications.

Documents Required from the Seller

Original or copy of the property title deed, updated at the Land Registry Office.

Original or copy of the Kimlik Card (for Turkish citizens).

Raiç Bedel (Property Valuation Document) issued by the municipality.

Original notarized power of attorney, if applicable.

Statement of no outstanding tax debts.

Mandatory earthquake insurance (DASK) proof.

Documents Required from the Buyer

Original or copy of the Kimlik Card (for Turkish citizens).

Original notarized power of attorney if using a lawyer.

For foreign buyers (non-Turkish citizens):

Translated and certified passport.

Translated national ID (birth certificate/card).

Official expert appraisal report (Ekspertiz), mandatory if applying for citizenship.

Financial and bank documents, including payment receipts and Döviz Alım Belgesi (Foreign Exchange Purchase Certificate).

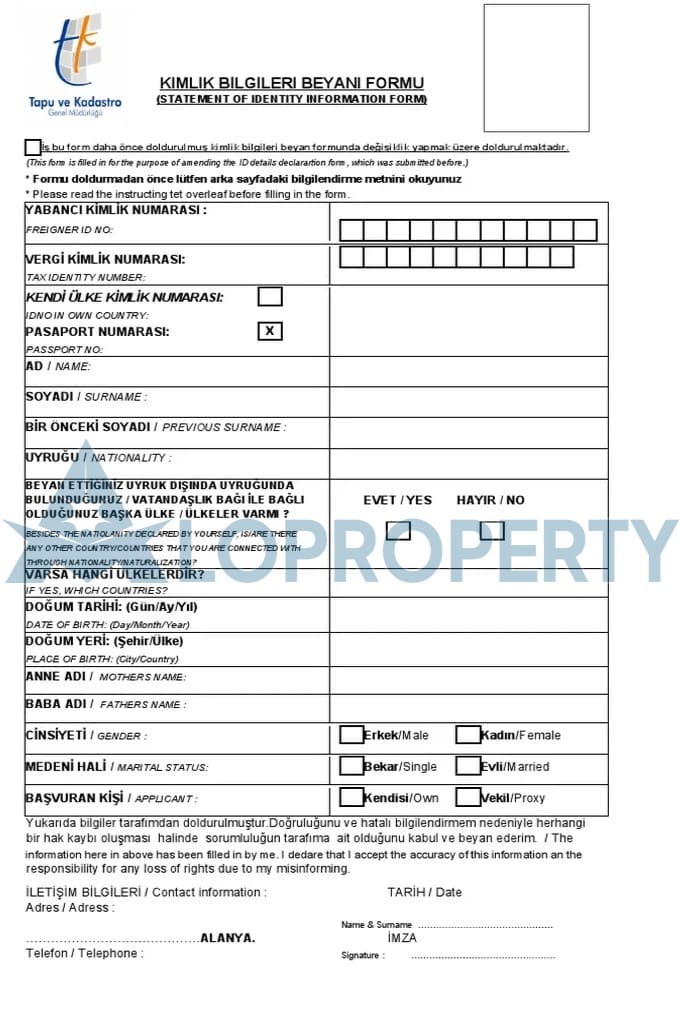

Declaration Form (Beyan Formu) from the Land Registry website.

Two biometric passport-size photos.

Tax identification number obtained online.

Payment receipts for title deed fees and stamp duty (no need to present during deed registration).

Additional Notes on Currency Transfer and Expert Report

Foreign nationals buying property in Turkey must transfer the purchase price in USD or EUR to their Turkish bank account. Then, the bank converts the currency to Turkish Lira and transfers it to the seller. After this, the bank issues a Döviz Alım Belgesi (Foreign Exchange Purchase Certificate), which must be registered in the Land Registry system to schedule the deed transfer appointment. The original certificate must be presented on the day of registration.

Some residential projects licensed as GYO (Real Estate Investment Trusts) allow buyers to skip the expert appraisal report, especially if the purchase is for citizenship purposes. This exemption makes buying property in Turkey more convenient in these projects.

Important Points Before Visiting the Land Registry Office (Tapu)

Before the buyer and seller go to the Land Registry Office to transfer the property deed, some essential steps must be taken to prevent possible issues and save time when buying property in Turkey. These steps include:

Thorough Document Review by Both Parties or Consultant:

Before starting the process, it is recommended that all documents be reviewed by a real estate agent or lawyer to ensure there are no errors or discrepancies.Ensure DASK Insurance is Ready:

The Land Registry Office will not register the deed without the mandatory earthquake insurance (DASK). Therefore, this insurance must be valid or renewed before the visit.Payment of Municipal Debts:

If there are outstanding municipal debts such as renovation fees or utility bills, the deed transfer may be blocked. The seller must settle these debts and obtain a clearance certificate from the municipality.Online Appointment Booking for the Tapu Office Visit:

In most regions of Turkey, visiting the Land Registry requires a prior appointment. This can be booked through the official website or the Web Tapu app.Coordination with an Official Translator (if needed):

If either party is a foreigner and not fluent in Turkish, the presence of an official translator is mandatory during the deed transfer.Preparation to Pay Related Fees:

Some fees such as the stamp duty (Döner Sermaye), deed transfer fee, and translator fees must be paid on the day of the visit. It is advisable to have sufficient cash or have payments made in advance.

Collecting all necessary documents for buying property in Turkey is the first and most crucial step toward a secure and legal transaction. Whether you are the buyer or seller, being fully prepared with the required documents speeds up the deed transfer process and prevents potential problems. Additionally, if one party is a foreign national, it is important to be aware of specific regulations related to foreigners to ensure a smooth buying or selling process.

Finally, it is highly recommended to consult real estate professionals and legal advisors before taking any steps to ensure your information is up-to-date and all documents are in order.

Property Purchase Costs in Turkey

When buying property in Turkey, there are several costs to consider. Being aware of them before proceeding will help you plan better. Here are the most important costs:

1. Deed Transfer Fee (Tapu):

One of the first costs you will encounter when buying property in Turkey is the official property deed transfer fee. This fee is 4% of the property’s declared price on the title deed and is paid to the government as the cost of transferring ownership from seller to buyer. According to Turkish law, this 4% fee is split equally: 2% paid by the seller and 2% paid by the buyer.

In Turkey’s real estate market, especially for second-hand property sales, there is a common custom that the buyer pays the entire deed transfer fee. Sellers usually sell their property on this condition and do not contribute to this cost. This practice is so widespread in second-hand transactions that most buyers are aware of it and plan their finances accordingly when buying property in Turkey.

Some regions in Turkey have been officially classified by the government as urban renewal zones (Bakıf Frasudeh). To encourage reconstruction and renovation in these areas, the government has set special conditions, including exemption from deed transfer fees. Therefore, if you purchase an apartment in a project located in an urban renewal zone, both buyer and seller are exempt from paying the deed transfer fee, reducing your overall costs when buying property in Turkey.

2. Real Estate Agent Fees in Turkey

One important point to consider when buying property in Turkey is the real estate agent’s fee or property expert’s commission. This fee varies depending on the type of transaction:

Buying Property Directly from the Developer:

When purchasing directly from a developer company, the real estate agent’s commission is fully paid by the developer. This means as a buyer, you do not have to pay any fees for the agent’s services. This benefit allows you to confidently enjoy professional consulting services without extra cost when buying property in Turkey.

Buying and Selling Second-Hand Properties:

For second-hand property transactions, the rules differ. According to Turkish law, each party (buyer and seller) must pay 2% of the transaction value as a commission fee to the real estate agent. Additionally, a 20% Value Added Tax (VAT) is added to the total commission amount. This VAT is calculated according to Turkish tax regulations and increases the final commission cost when buying property in Turkey.

3. Property Valuation and Appraisal Fees in Turkey (Expertise Report)

To protect foreign investors and increase transparency in real estate transactions, the Turkish government has made it mandatory to provide a property appraisal report (expertise report) before the property deed transfer. This report is prepared by official government-approved experts and plays a key role in ensuring the accuracy and safety of the transaction during buying property in Turkey.

Details of the Property Appraisal Report:

The report examines the property from several aspects:

Possible outstanding debts related to the property

The existence and physical condition of the property

The actual ownership of the seller

The fair market value of the property

This report is one of the essential documents required during the deed transfer process (Tapu) and helps prevent any fraud or financial loss for foreign buyers when buying property in Turkey.

Costs and Exceptions:

The appraisal report fee is paid by the buyer and currently set by the government at around 6,000 Turkish Lira. This procedure is specially designed for foreign investors and is a critical step in buying property in Turkey.

Exemption for Projects with GYO License:

If you buy from projects licensed under GYO (government-approved real estate companies), you are not required to provide an appraisal report. In these cases, the residency or citizenship process in Turkey can proceed without this certificate.

Exemption for Residency Buyers (Without Citizenship Application):

If your sole purpose in buying property in Turkey is to obtain residency (not citizenship), providing an appraisal report is not mandatory. You can complete the deed transfer process without submitting this report.

4. Official Translator Fees: Ensuring Transparency in Deed Transfer

One of the additional costs involved in buying property in Turkey is the fee for translating documents and the presence of an official translator during the deed transfer process. This step is crucial to ensure transparency and full understanding of all legal procedures by the buyer, and it is mandated by the Turkish government.

Role of the Official Translator in the Deed Transfer Process:

Document Translation: Buyer’s documents such as passport, national ID card, and birth certificate must be officially translated into Turkish and certified to be accepted by the Tapu office.

Presence at the Deed Transfer Meeting: On the day of the transfer, a government-approved official translator must accompany the buyer to avoid any misunderstandings.

Important Note:

This fee remains fixed regardless of the type of property purchase—whether buying from new Istanbul projects or second-hand properties—and is part of the legal requirements for buying property in Turkey. If the buyer is fluent in Turkish, the presence of an official translator on the transfer day is not required.

5. Property Purchase Tax in Turkey (KDV)

Value Added Tax (VAT or KDV) is a significant cost when buying property in Turkey, varying depending on the property type and conditions. This tax can range from 0% in certain special cases up to 20% of the property price.

For luxury properties or properties located on land that was previously designated for military use, KDV can be as high as 20%.

Tax Exemption for Foreign Investors:

A major advantage for foreign buyers is a KDV tax exemption available under specific conditions. Foreign investors purchasing property in Turkey for the first time, who do not hold any Turkish residency, can benefit from a 90% exemption on KDV tax. This exemption provides a remarkable opportunity to reduce overall costs when buying property in Turkey.

How Ownership Transfer Works in Turkish Real Estate Transactions

Ownership transfer in Turkey is conducted through a structured process fully supervised by the government to ensure legal security for buyers, especially foreigners. The procedure starts by preparing initial documents including the property appraisal report (expertise), tax identification number, identity documents, and other necessary paperwork.

After verifying the documents, all related fees such as transfer taxes and additional costs are paid. On the scheduled day, with the buyer, seller, and official translator (if applicable) present at the Land Registry Office (Tapu), the ownership deed is officially transferred to the buyer. This careful process guarantees safety and transparency when buying property in Turkey.

Types of Apartment Purchases in Turkey

Buying property in Turkey is generally done in two ways: purchasing directly from the developer (new projects) or buying a second-hand property. Each option has its own advantages and disadvantages, which can significantly impact investors’ decisions. In this section, we will explore the differences between these two purchase methods.

1. Buying an Apartment from the Developer

Buying an apartment from a developer in Turkey means purchasing directly from construction companies or real estate developers. This can be for properties that are either under construction or ready for delivery.

One of the benefits of buying from a developer is the ability to choose your unit and pay either in full or through installment plans. Buying from a reputable developer ensures that the property is legally sound and structurally reliable, as the developer is responsible for the entire construction process and official property registration.

Advantages:

Buying from a developer means getting a brand-new property, usually featuring the latest designs and modern amenities. These apartments typically do not require any repairs or renovations.

Most reputable developers in Turkey offer warranties on construction quality and facilities, making the purchase safer for buyers.

New projects often include modern amenities such as swimming pools, gyms, private parking, and green spaces, making buying from the developer more attractive.

Purchasing from developers, especially in developing areas, can be very profitable for investors in the long term.

Some developers offer pre-sales of units still under construction with interest-free installment plans, which makes property investment more accessible.

Disadvantages:

New projects generally have higher prices compared to older apartments, which might be a bit expensive for some buyers, especially in central or luxury areas.

When buying an under-construction apartment, you cannot fully inspect the unit until the project is completed; you can only review the floor plans and layouts.

2. Buying Second-Hand Property

While researching buying property in Turkey, you will likely come across the term “second-hand property.” This refers to properties whose ownership has been transferred at least once before. Second-hand does not necessarily mean the property has been used; even newly built properties that have had their title deed transferred once are considered second-hand.

Buying second-hand property is usually more complex and challenging than purchasing from developers or new projects. Due to tax laws in Turkey, some sellers tend to declare a lower price on the title deed to avoid higher taxes. This discrepancy between the real price and the declared price can cause issues for buyers.

An important point for those buying second-hand properties to obtain citizenship is that the last three owners of the property must be of Turkish origin. This is a crucial detail that requires careful verification.

It is strongly recommended to work with experienced real estate consultants when buying property in Turkey, especially second-hand properties, to ensure all legal steps are properly followed and to avoid unexpected problems.

Types of Residential Properties in Turkey

To make the best choice when buying property in Turkey, whether for investment or residence, it is essential to be familiar with the property purchase laws and the different types of properties available in the country. In this section, we provide concise and practical information to help you make the right decision.

1. Normal Apartment

These apartments are similar to privately built apartments in Iran but usually do not include a private parking space. In cities like Istanbul, normal apartments typically lack amenities such as security services, swimming pools, or gyms. Some of these units may also have multiple basement floors. Due to their lower monthly maintenance fees, these apartments are considered an economical option for buyers who are buying property in Turkey on a budget.

2. Site (Residential Complex)

Sites generally offer full amenities such as open and indoor swimming pools, fitness centers, 24-hour security, private parking, and green spaces. These complexes consist of multiple blocks and are priced higher than normal apartments due to their added value. Monthly maintenance fees for sites are higher because of the extensive facilities they provide. Choosing a site is a popular option for those buying property in Turkey who seek more comfort and convenience.

3. Residence (Luxury Complexes)

Residences offer amenities similar to sites but are more luxurious and usually consist of fewer buildings, typically 1 to 3. These properties are often located in prime locations and built with higher quality standards. Monthly maintenance fees for residences are considerably higher than those for sites. In terms of price, residences are more expensive than both sites and normal apartments, making them a premium choice for buyers interested in buying property in Turkey with luxury preferences.

4. Villa

Villas are houses that come with a yard, garden, and green spaces and are built up to a maximum of four floors. They are mainly classified into two types:

Detached Villa: The entire building belongs to a single owner.

Twin Villa (İkiz Villa): Two independent but adjoining buildings sharing some common facilities, each with a separate owner.

Villas can also be found within gated communities (sites) that provide shared facilities and 24-hour security. Villas inside luxury sites generally have higher value compared to detached villas with similar location, size, and construction quality.

Because villas are located in upscale and sought-after areas, they attract wealthy buyers and Turkish celebrities, placing them among the highest-priced property types.

With an understanding of the types of residential properties in Turkey, you can now make better choices based on amenities, property value, and your budget. This knowledge will help you make a more confident decision whether you are buying property in Turkey for residence or investment purposes.

Restricted Neighborhoods for Foreign Residency When Buying Property in Turkey

When purchasing property in Turkey, it is very important to pay attention to the residency-restricted neighborhoods designated by the Turkish government. This law, implemented in 2022, aims to control the concentration of foreign immigrants in certain specific areas.

According to this regulation, in neighborhoods where more than 20% of the population consists of foreign immigrants, foreigners cannot obtain residency by buying property in Turkey. This restriction is designed to manage immigration and prevent excessive clustering of foreigners in some districts. However, it is important to note that this rule applies only to residency permits and does not affect the ability to obtain Turkish citizenship through property purchase, which remains possible throughout Turkey, even in restricted neighborhoods.

Therefore, if your goal is to acquire residency through buying property in Turkey, you must check the status of the neighborhood before finalizing your transaction.

Why You Need a Real Estate Consultant When Buying Property in Turkey

Choosing a reputable and experienced real estate consultant should be a top priority when buying property in Turkey. As you know, property purchase and residency laws in Turkey are complex and differ significantly from countries like Iran. To succeed in this process, having a professional and knowledgeable consultant is essential.

Turkey is a popular destination for immigration, attracting a large influx of migrants from various countries. This has led the Turkish government to continually update laws regulating the real estate market as well as residency and citizenship requirements. Staying informed about these changes is crucial for foreign buyers and investors.

Working with a real estate consultant allows you to proceed confidently and smoothly in the property buying process. Experienced consultants, fully aware of the legal procedures for ownership transfer and residency or citizenship acquisition, can guide you through important decisions and help you avoid potential pitfalls when buying property in Turkey.

Frequently Asked Questions (FAQs) About Buying Property in Turkey

Can foreigners buy property in Turkey?

Yes, foreigners can buy property in Turkey with full ownership rights.

What is the minimum property value required to obtain residence permit through buying property?

Currently, the minimum property value to qualify for a residence permit is $200,000 USD.

Can buying commercial or office property grant a residence permit?

No, only residential properties meeting the minimum value requirement are eligible for residence permits.

What additional costs should I expect when buying property in Turkey?

Common costs include title deed fees (Tapu), VAT (KDV), real estate agent commission, and official translator fees.

Do I need a tax identification number before buying property?

Yes, obtaining a Turkish tax identification number (Vergi Numarası) is mandatory before purchasing property.

Is it necessary to have a property appraisal report (expertise report)?

Yes, an official appraisal report is usually required, especially for foreign buyers, unless the property is from a licensed GYO project.

Can I buy multiple properties to meet the residence permit requirement?

No, the total value of properties must be on a single property that meets the minimum threshold.